If you’re collecting miles & points through credit card spending, I always recommend doing what you can to accrue transferable points currencies.

That’s because these points are much more flexible than when you’re earning an individual airline or hotel points currency. You have the ability to transfer these points to all kinds of travel partners, and you’re safeguarded from a devaluation in a specific points currency.

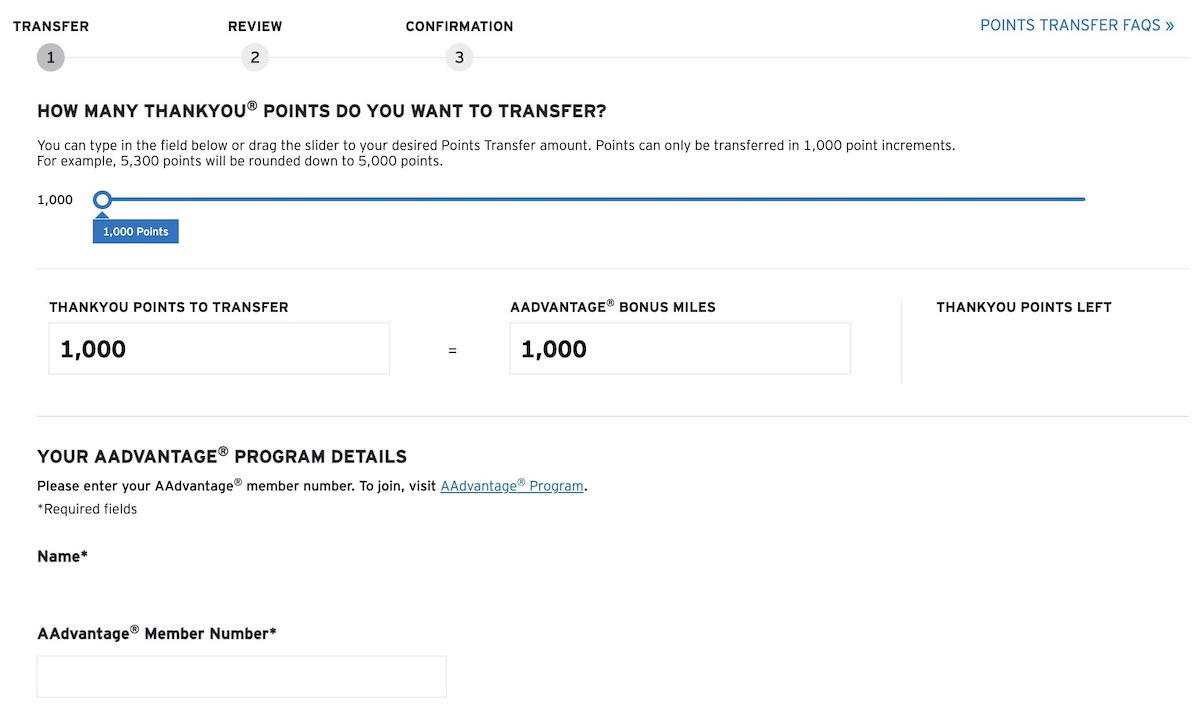

With that in mind, in this post I’d like to address all the basics of transferring Citi ThankYou points. How many partners does Citi ThankYou have, how long does it take for points to transfer, which programs can you transfer points to, etc.

How many airline and hotel partners does Citi ThankYou have?

As of now, Citi ThankYou has a total of 19 transfer partners, including 15 airline loyalty programs and four hotel loyalty programs. Below you’ll see all the partners, plus the transfer ratios, assuming you have either the Citi Strata Elite℠ Card (review), Citi Strata Premier® Card (review), or discontinued Citi Prestige Card.

Note that you can also transfer points directly to select partners if you have no annual fee products like the Citi Strata℠ Card (review) or Citi Double Cash® Card (review), though the transfer ratio isn’t as good. So ideally you’ll have one of the premium cards, so that you can maximize the value of all your points.

How long do Citi ThankYou points transfers take?

Below is a chart with how long it typically takes to transfer ThankYou points to airline and hotel partners.

As you can see, points transfers to most ThankYou partners are instant, while point transfers to the other partners take anywhere from hours to days. I always appreciate when people have data points on recent points transfer times. I’ve tried to keep the list updated based on feedback, but over time we do see more and more partners offer instant transfers.

Keep in mind that there are some factors that can cause points to not move over as expected, so don’t be surprised if that happens once in a while.

Are there fees when transferring Citi ThankYou points?

No, there are no fees associated with transferring Citi ThankYou points to any airline or hotel partners.

Can you transfer Citi ThankYou points to someone else’s Citi account?

Citi lets one transfer ThankYou points to anyone else’s ThankYou account, regardless of whether they’re related, live at the same address, etc. However, there are a few restrictions to be aware of:

- Shared points expire 90 days after they’re received, so you can’t “hoard” someone else’s points in your ThankYou account

- The recipient of shared points can’t share those same points with another member

- You can share at most 100,000 points per calendar year, and can have at most 100,000 points shared with you per calendar year

While there are some restrictions, this is an area where Citi ThankYou is more generous than other programs.

Can you transfer Citi ThankYou points to someone else’s partner account?

No. While you can transfer your Citi ThankYou points to someone else’s Citi ThankYou account and then they can transfer it to their preferred loyalty program, you can’t transfer your ThankYou points directly to someone else’s loyalty program account.

The name of the Citi ThankYou account and loyalty program account have to match.

Can you combine Citi ThankYou accounts?

While Citi is generous in letting you transfer ThankYou accounts to someone else’s ThankYou account, the bank actually has a rather strict policy when it comes to combining your own ThankYou points accounts.

For example, let’s say you have the Citi Strata Elite℠ Card (review) and Citi Strata℠ Card (review). Now let’s say you close down one of those accounts. While you can combine the points, the points from the card that you shut down expire 60 days after the account is closed. So you have to transfer those points to a partner program within 60 days, or else the points will be forfeited.

What cards earn Citi ThankYou points?

Nowadays there are several great cards earning Citi ThankYou points. The way I view it, you’re going to want to have either the Citi Strata Elite℠ Card (review) or Citi Strata Premier® Card (review), at a minimum. These are the two excellent cards that are open to new applicants that let you unlock the full value of the Citi ThankYou ecosystem.

Then I think there’s lots of merit to complementing one of those cards with the Citi Strata℠ Card (review) and/or Citi Double Cash® Card (review). These no annual fee cards can boost your points earnings, so they can make for a great credit card duo.

For example, I think it’s tough to beat the combination of the Citi Strata℠ Card (review) and Citi Double Cash® Card (review). The former has a reasonable $95 annual fee, and there’s a lot to love about the card, including the fantastic bonus categories, like the ability to earn 3x points on dining, gas stations and EV charging, supermarkets, air travel, and hotels.

Then the Citi Double Cash® Card (review) offers 1x points when you make a purchase, and 1x points when you pay for that purchase, so it’s ideal for everyday spending.

Should you transfer Citi ThankYou points to travel partners?

In general, the best use of Citi ThankYou points is to convert them into airline miles. Personally, my favorite transfer partners include Air France-KLM Flying Blue, American AAdvantage Avianca Lifemiles, EVA Air Infinity MileageLands, Singapore KrisFlyer, and Virgin Atlantic Flying Club.

However, you only want to transfer points once you’ve figured out the award you want to book, have verified availability, and are sure you understand how that program works.

If you’re someone who prefers to redeem your points as cashback toward travel, points can generally only be redeemed for at most one cent each toward the cost of a travel purchase, which isn’t exactly great. I think transferring Citi points to airline partners represents a better value.

Bottom line

Citi ThankYou is one of the major transferable points currencies. Citi has some awesome airline and hotel transfer partners, and there are also great credit cards earning these points. As I see it, the best play is to get the Citi Strata Elite℠ Card (review) or Citi Strata Premier® Card (review) as a “hub” card for ThankYou points, and then picking up cards like the no annual fee Citi Strata℠ Card (review) or Citi Double Cash® Card (review) to maximize your points earning potential.

Hopefully the above is a useful guide of what to expect when it comes to transferring Citi points to partners.

If you have any data points on how long Citi ThankYou points transfers have taken you, please share them below, so that I can keep the chart as accurate as possible!