There are countless travel cards on the market, but some are better than others. Here at Thrifty Traveler, we’ve got a couple of favorites: The *amex gold* and the *venture x*. It’s time to put them head to head.

For years, the Amex Gold Card has been one of the strongest travel cards on the market, thanks to a (relatively) reasonable annual fee and unbeatable bonus-point earning on groceries and dining, making it a go-to card for earning more points for everyday expenses. But the Venture X Card has taken the premium travel credit card landscape by storm, offering perks like lounge access, annual travel credits, and a massive welcome bonus all at a cheaper annual cost than what its competitors charge.

While they’re both strong options, these cards have some key differences that could make one a clear winner over the other. So keep reading for a full breakdown of the Capital One Venture X vs. the Amex Gold Card.

Thrifty Tip: Looking for a new travel card, but not sure where to start? Check out CardPilot, our brand-new tool designed to help beginners and experts alike choose the right card to fuel their travels!

Comparing Annual Fees

Neither of these cards is cheap, exactly. But that doesn’t mean they’re not worth that money.

The annual fee on the Capital One Venture X card is $395. Compare that to the $325 annual fee on the Amex Gold Card (see rates & fees).

That means each and every year, you’re saving $70 with the Amex Gold Card as opposed to the Venture X. But the story certainly doesn’t end there. As you will find with most travel rewards cards in the middle or top of the market, bigger annual fees often mean bigger benefits, and that is certainly the case with both of these cards.

Winner: American Express® Gold Card

Depending on how you use the benefits, even a card with a higher annual fee can make more financial sense. But if we are simply looking at out-of-pocket costs each and every year, the Amex Gold card is the clear winner in this category.

Learn more about the *amex gold*

Lounge Access

This category alone could sway travelers one way or the other.

The Capital One Venture X card provides access to the Capital One Lounges. Cardholders will also get a complimentary Priority Pass Select membership that opens the doors to another 1,300-plus airport lounges around the globe.

Capital One has now opened a handful of its own lounges, giving Venture X cardholders exclusive free access. These lounges are truly incredible spaces, with great design, fun amenities, and outstanding complimentary food and drinks. Venture X cardholders and two guests can get in for free. However, starting on Feb. 1, 2026, Venture X cardholders can no longer bring free guests into the lounges with them.

To bring guests inside Capital One Lounges starting next February, Capital One Venture X cardholders will have to pay $45 apiece or a discounted rate of $25 for children 17 and under. Meanwhile, kids under 2 years old will remain free. Cardholders can retain complimentary guest access by charging a whopping $75,000 to their card in a calendar year – a carbon copy of the policy American Express adopted at Centurion Lounges a few years ago.

To top it all off, even Venture X cardholder’s Priority Pass lounge access is taking a hit, as cardholders will have to pay an additional $35 per guest. Venture X Business cardholders, however, can continue bringing two free guests into Priority pass lounges.

Not only can Venture X cardholders currently get in with two guests for free, but authorized users can get the same complimentary lounge access, too … and adding up to four of those additional users is completely free! That’s a recipe for some crowded lounges. But come February, adding an authorized user (with lounge access) will cost an extra $125 per year – no longer the bargain it currently is.

On the flip side, the American Express Gold Card doesn’t offer any sort of lounge access. For lounge access in the American Express card portfolio, you’d have to opt for the much more expensive *amex platinum* which has an annual fee of $695 each year (see rates and fees).

Winner: Capital One Venture X Rewards Credit Card

If lounge access is what you’re after, the Venture X is your answer. Just know, this benefit is getting slightly less valuable come next year.

Learn more about the *venture x*.

Welcome Bonuses

When you first sign up for a travel credit card, it’s all about the welcome bonus. Comparing the Capital One Venture X and Amex Gold, you really can’t go wrong. But there is a clear winner.

With the Capital One Venture X Card, you’ll earn 75,000 Capital One Venture Miles after spending $4,000 in the first three months of card membership. Considering you earn 2x on every dollar you spend, that bumps your total earnings to 83,000 – worth at least $830 toward travel.

With the Amex Gold card, your mileage may vary: bonus_miles_full

If you’re eligible for the big 100,000-point welcome offer, it’s worth a minimum of $1,000 when redeemed for airfare through American Express Travel® – and potentially a lot more if you leverage Amex transfer partners.

No matter how you slice it, spending $4,000 to $6,000 is no small matter. Credit cards are serious business: You should never open a new card and spend money you can’t pay off immediately just to earn some points or miles. If you can’t do so responsibly, it’s not worth it.

That said, there’s no question that earning the maximum bonus on the Gold Card is a bit easier with $6,000 in spending required over a six-month span. Earning the 75,000-mile bonus on the Venture X requires spending $4,000 in half the amount of time.

Winner: Capital One Venture X Rewards Credit Card

Knowing all that, we still have to give the slight edge to the Venture X. While it is possible to earn an offer as high as 100,000 points on the Amex Gold, that’s no guarantee.

Learn more about the *venture x*.

Earning More Points

Both these cards give you a reason to keep swiping your cards after earning the bonus. But just which one is better depends on where you’re spending money.

On the Capital One Venture X, you’ll earn 2x miles on each and every purchase. That’s tough to beat. Beyond that, you’ll earn 5x points on flights and 10x on hotels and car rentals – but only when booking through the Capital One Travel Portal.

With the Amex Gold Card, you won’t find a better option for your restaurant and U.S. supermarket spending, period. You’ll earn 4x Membership Rewards points for every dollar spent at restaurants worldwide (up to $50,000 annually, then 1x). You’ll also earn 4x points for every dollar you spend at U.S. supermarkets (up to $25,000 annually, then 1x).

On top of that, you’ll earn 3x points per dollar spent directly with airlines or at amextravel.com, the bank’s travel booking platform.

So here’s what it comes down to: Which is better? Earning 2x on every single purchase (or more through Capital One Travel) with the Venture X? Or earning 4x at restaurants and U.S. supermarkets, and 3x on flights and amextravel.com bookings?

Winner: Tie

We’d call this one a draw, but your own spending habits could sway you one way or the other. In fact, we think these cards work well together. Use the Gold for your restaurant and supermarket spending, and the Venture X card for everything else.

Annual Credits

Both the Capital One Venture X and Amex Gold Card offer credits that can drastically offset your annual fees. But none of them are exactly straightforward.

Let’s start with the Venture X Card, which is much simpler. Each and every year, you’ve got the card starting right from the time you open it, you’ll receive a $300 annual credit. Right off the bat, that essentially brings your cost for holding the card from $395 a year down to $95 a year.

Read more: Why the Capital One Venture X Annual Fee Shouldn’t Scare You

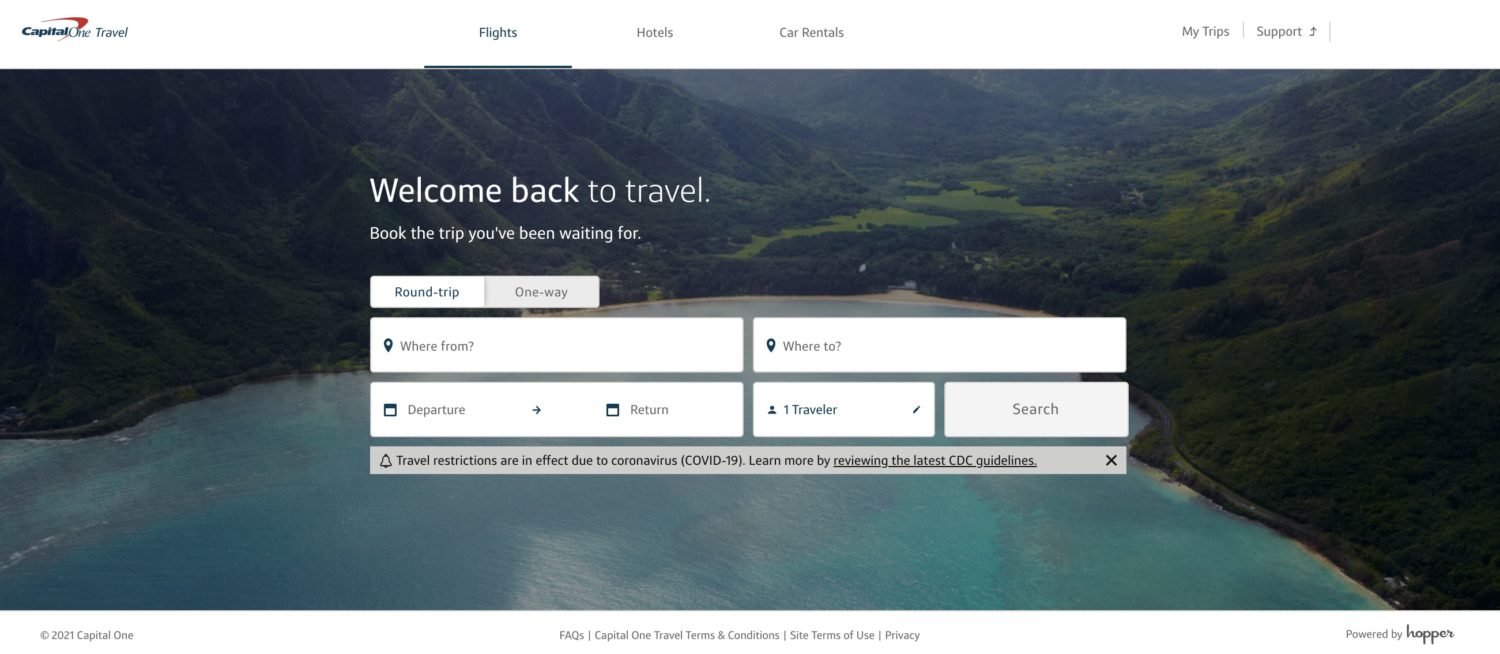

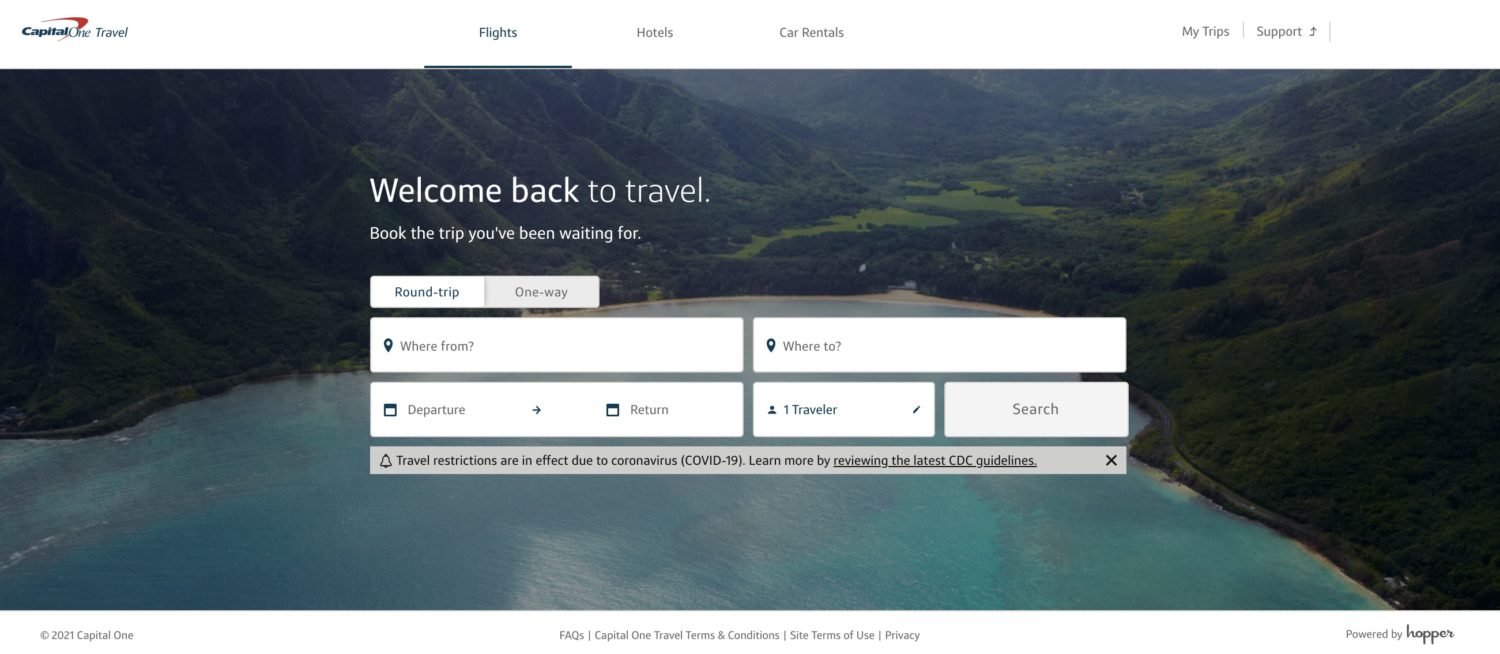

However, that credit is only valid for purchases you make within the Capital One Travel Portal. But Capital One has improved its travel portal with a handful of new features that could incentivize you to use its portal to book your travel.

They partnered with Hopper to give cardholders price freeze options, refunds if your flights drop in price after booking, and other predictive and powerful analytics. Plus, you earn up to 10x on travel on those purchases – even when using your $300 annual credit. Just charge your travel purchase to your Venture X Card and voila – it kicks in automatically.

The Amex Gold essentially comes with four annual credits, totaling over $400 in value each year. But they’re much more convoluted.

You’ll also get up to $120 in dining credits each year to spend at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar (until Sept. 25, 2024), and Five Guys, $84 Dunkin’ Credit, $100 Resy Credit, and up to $120 annually in Uber cash to use at both Uber and Uber Eats. These statement credits are given out in $10 monthly increments, and any amount you don’t use at the end of the month will be forfeited.

Just add your Gold Card to your Uber account, and each month, you will automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S. An Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit.

Maximizing these credits alone will cover all your $325 annual fee and then some. These credits and bonus categories are a big reason why we feel the card is easily worth the $325 annual fee.

Winner: Capital One Venture X Rewards Credit Card

This is close. But from our perspective, putting the $300 credit on the Venture X to use is much easier. And that gives it the edge here.

Learn more about the *venture x*.

Global Entry or TSA PreCheck Credit

There are some other perks that aren’t earth-shattering. And this is one of them, though it’s still a nice perk.

The Capital One Venture X card gives you up to a $120 credit to cover the cost of Global Entry or TSA PreCheck. That’s fairly common these days among premium travel cards. Even the cheaper Capital One Venture Rewards Credit Card offers it.

Just pay your application fee with your card and poof – the credit kicks in to automatically cover the cost. You get this credit once every four years, and membership in either program lasts for five years. That means you’re set.

Can’t decide? Go for Global Entry, as that comes with TSA PreCheck benefits but also gets you into a designated customs and immigration line when returning to the U.S. from abroad.

Winner: Capital One Venture X Rewards Credit Card

The Amex Gold Card doesn’t offer any reimbursement for TSA PreCheck or Global Entry. That makes the winner in this category an easy pick.

Learn more about the *venture x*.

Using Points to Book Travel

When it comes to booking travel, let’s compare what you get with both Capital One and Amex. And we’ll start at the easiest level.

Both Amex and Capital One run their own travel portals that allow you to book flights, hotels, and rental cars using your points and miles. The value is the same: With each card, you’ll get 1 cent toward travel for each point or mile you use.

But the Venture X has an ace-in-the-hole: Capital One Purchase Eraser, the easiest and most straightforward way to book travel using points and miles. Rather than searching through portals, you can simply book a flight, hotel, or other travel expense with your card, then go back and erase the purchase using your miles. Once again, every 1 Venture Mile = 1 cent toward your travel purchase.

Read More: 9 Unique Ways to Use the Capital One Purchase Eraser for Travel

Winner: Capital One Venture X Rewards Credit Card

The ease of redeeming Venture Miles gives the Venture X Card a win here.

Learn more about the *venture x*.

Transfer Partners

You can go beyond travel portals or purchase erasers and get even more value out of your points and miles by leveraging transfer partners. For years, American Express and Chase had reigned supreme when it comes to transfer partners. But Capital One is closing the gap, and fast.

A few years ago, Capital One launched its own stable of airline transfer partners. But it wasn’t a great deal: In most cases, you’d have to transfer 2 Venture Miles to get 1.5 airline miles in return. That meant 50,000 Venture Miles would get you just 37,500 miles with your airline of choice. All Chase and most American Express transfers, meanwhile, are on a 1:1 basis.

But Capital One has improved drastically, adding more options, a few hotel chains, and making almost all of them 1:1 transfer partners. This puts their transfer partner network on a more level playing field with both Amex and Chase.

Check out the full list of Capital One transfer partners.

| Program | Type | Ratio | Transfer Time |

|---|---|---|---|

| Aeromexico | Airline | 1:1 | Instant |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| Avianca LifeMiles | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific AsiaMiles | Airline | 1:1 | Up to five business days |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Up to 1 day |

| EVA Air | Airline | 2:1.5 | Up to five business days |

| Finnair | Airline | 1:1 | Instant |

| JetBlue | Airline | 2:1.2 | TBD |

| Qantas | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| TAP Air Portugal | Airline | 1:1 | Same day |

| Turkish Airlines | Airline | 1:1 | Same day |

| Virgin Red | Other | 1:1 | Same day |

| Accor | Hotel | 2:1 | Up to two business days |

| Wyndham | Hotel | 1:1 | Same day |

| Choice Hotels | Hotel | 1:1 | Same day |

Read up on Capital One transfer partners, how transferring works, and your best options!

As mentioned, Amex has been among the gold standard for transferring points for years, with more than two dozen options and counting. There’s a lot of overlap between which airlines you can send your points to between Amex and Capital One, but Amex still stands out in a few ways.

Here’s the full list of Amex transfer partners.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | N/A |

| AeroMexico | Airline | 1:1.6 | 2-12 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Hawaiian | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | 1-3 days |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

| Choice Privileges | Hotel | 1:1 | Instant |

| Hilton Honors | Hotel | 1:2 | Instant |

| Marriott Bonvoy | Hotel | 1:1 | Instant |

No bank does a better job of offering frequent transfer bonuses than Amex. By giving travelers a bonus of 10% to 40% or more when sending their points to a specific airline or hotel, it’s a relatively easy pathway to earn some additional points and miles.

Capital One has offered these bonuses, but they seem to be less frequent.

Plus, Amex has the ability to transfer points to Delta SkyMiles. Capital One doesn’t have a U.S. airline transfer partner, which is a weakness. And while Capital One has hotel transfer partners, Amex’s are stronger.

With that in mind, Amex wins when it comes to transfer partners. But Capital One is closing in fast – especially with valuable niche options like Turkish Airlines. Which card is better for transferring points will ultimately depend on how you want use them.

Winner: American Express® Gold Card

Learn more about the *amex gold*

Travel & Rental Car Insurance

The best travel cards help protect you when things go wrong – and help you avoid paying for add-on coverage.

The Venture X Card offers strong travel insurance coverage when booking flights like trip interruption and delay insurance. But where it really shines is with rental car insurance – an area where the Gold Card doesn’t offer coverage.

Read more about the Capital One Venture X rental car insurance benefits!

Charge your rental car to your Venture X, and you get the strongest rental car insurance you’ll find. Decline the rental car agency’s policy and you’ll have a strong insurance policy that will cover most damages or even the theft of the vehicle. It applies to rentals in the U.S. as long as 15 days and in most foreign countries for up to 31 days.

Winner: Capital One Venture X Rewards Credit Card

This one isn’t even close … the Venture X offers some of the best travel insurance of any card on the market and the Amex Gold doesn’t even come close. If added peace of mind is what you’re after, the Venture X is the clear favorite here.

Learn more about the *venture x*.

Which Card is Best?

By the numbers, the Venture X card wins six categories, Amex Gold wins two, and one ends in a tie. But at the end of the day, every traveler should weigh each category differently.

While the annual fee is a little higher on the Venture X card, you are simply getting more travel benefits that can help you offset that fee. With the Amex Gold, you simply won’t find a better card in terms of your return on restaurant and U.S. supermarket spending.

If you’re after lounge access, the Venture X is a great choice. And with the $300 annual travel credit plus the 10,000-mile anniversary bonus that starts in year two, it’s possible to come out ahead on the card’s $395 annual fee from those two benefits alone. It’s why we always encourage readers to do the math before ruling out cards with larger annual fees.

Bottom Line

The Capital One Venture X Card has shaken up the premium travel card market. But with a $395 annual fee, it’s directly competing with cards in the middle of the market as well.

In the end, when comparing Venture X vs Amex Gold, which of these cards is best depends on which perks and benefits you value most – and how much you’re willing to pay for them.