Link: Apply now for the Sapphire Reserve for BusinessSM

The Sapphire Reserve for BusinessSM (review) is Chase’s new premium business card. While the card has a steep $795 annual fee, there are lots of reasons to consider picking up this card, including an absolutely massive welcome bonus of 200,000 Ultimate Rewards points after spending $30,000 within the first six months.

I decided to apply for this new card, and want to report back with my experience. I just couldn’t turn down the huge incentive to apply, plus figured I’d give the card’s value proposition a spin.

Basic Sapphire Reserve Business application restrictions

Eligibility for the Sapphire Reserve Business, including for the welcome offer, is unrelated to which other Chase cards you have. That’s a major incentive to pick up this card over one of the other options.

For example, you’re eligible for the welcome offer even if you have the personal version of the card, the Chase Sapphire Reserve® Card (review). You’re also eligible for the welcome offer if you have another Chase business card, like the Ink Business Preferred® Credit Card (review).

As a matter of fact, the card doesn’t even have any “once in a lifetime” language, or anything similar, in the offer terms. So in theory, you might even be eligible for the card (including the offer) multiple times.

Beyond that, Chase has fairly few consistent restrictions when it comes to approving people for business cards. Chase is known for the 5/24 rule, though that’s no longer consistently enforced. I just wouldn’t recommend applying for more than one Chase business card every 30 days, but even that isn’t a strict limit.

Sapphire Reserve Business application process

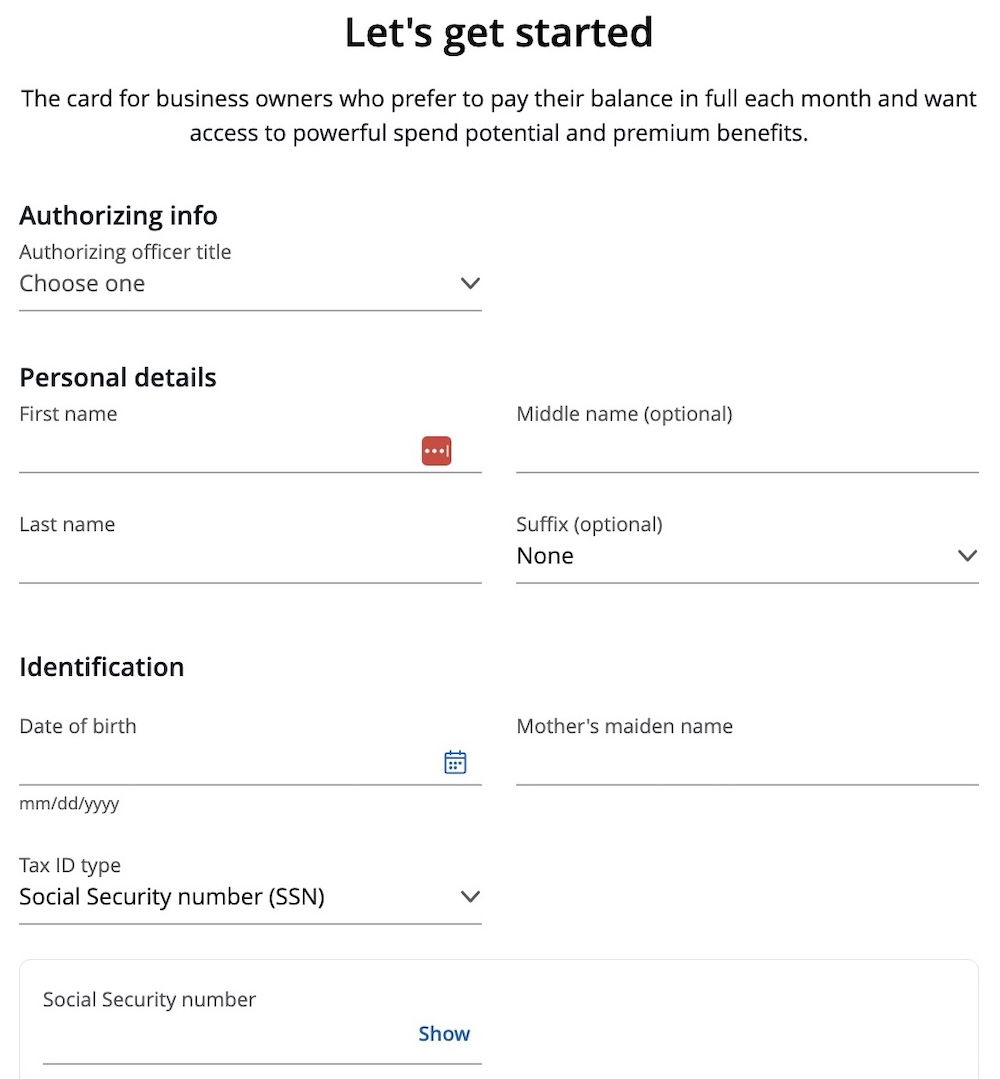

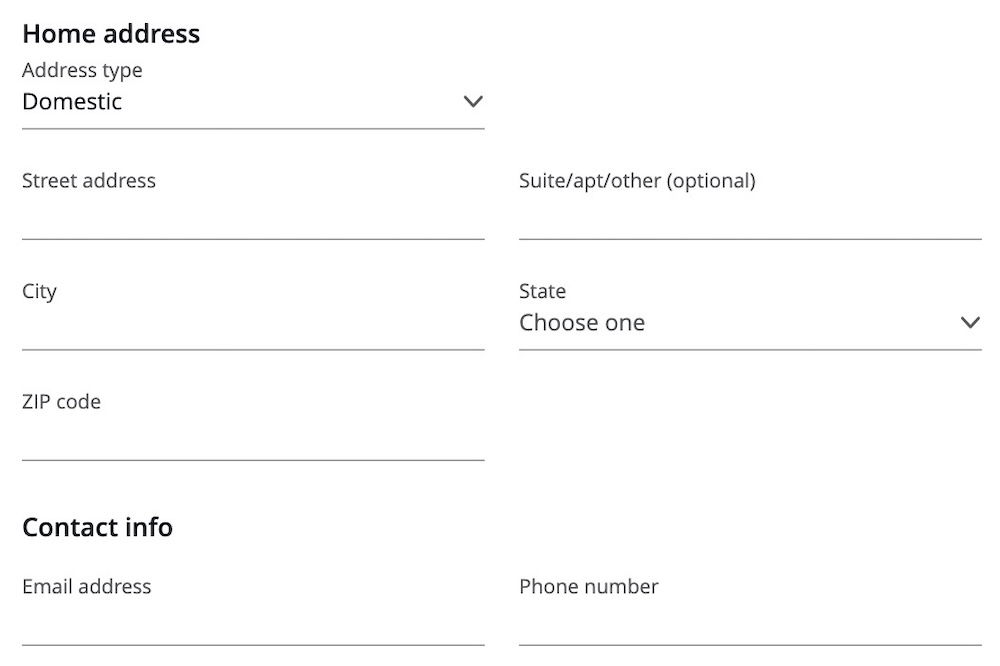

The Sapphire Reserve Business application process is pretty straightforward, and consists of just one continuous page.

The first section asks primarily for personal information, similar to what you’d expect to provide when applying for a personal credit card. We’re talking things like name, address, social security number, income, etc.

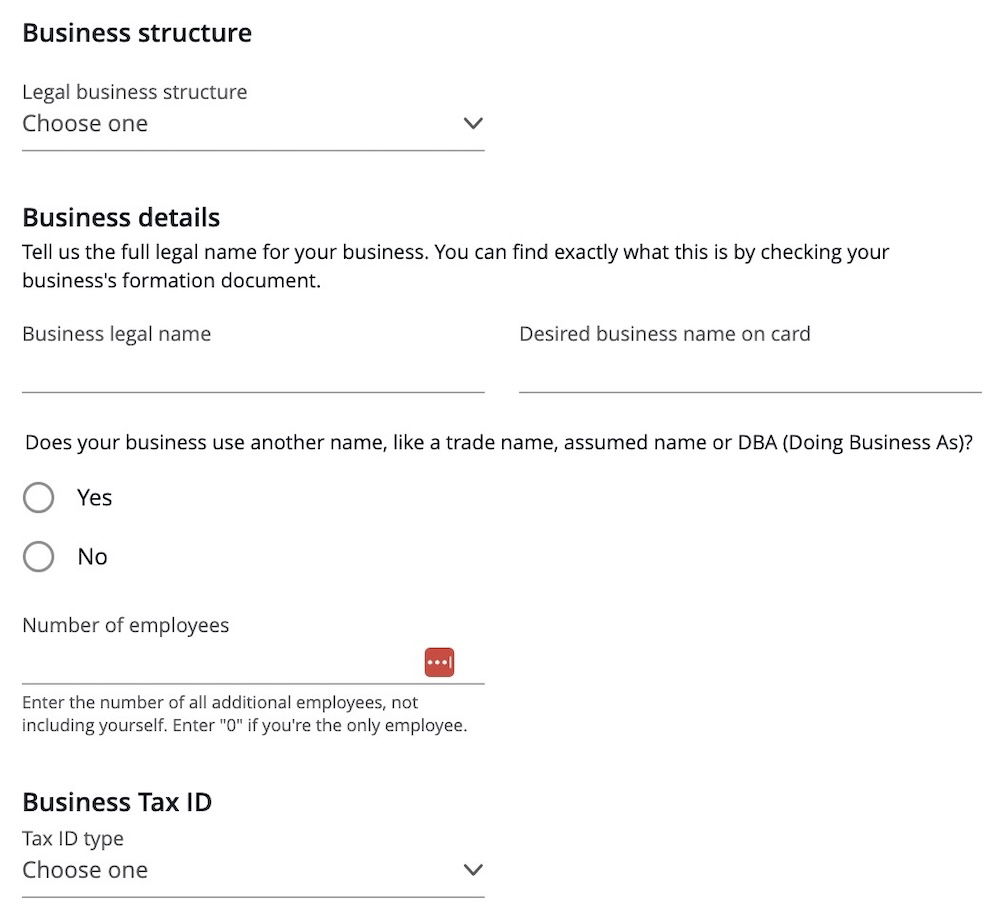

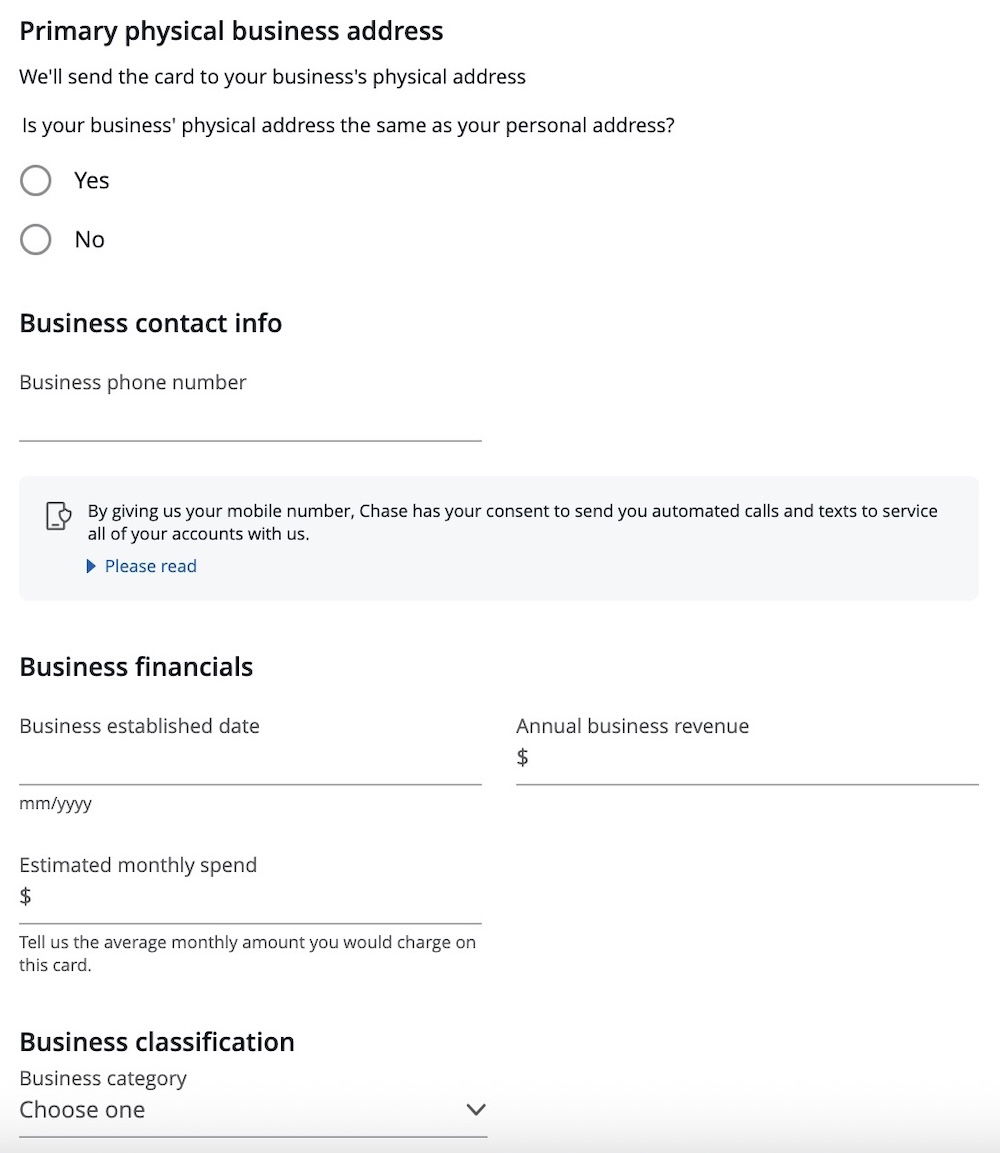

The second part of the application asks for business details, including the legal business structure, business name, business establishment date, business income, etc.

Keep in mind that you can apply for this card as a sole proprietorship, in which case you can use your social security number as the business tax ID. If you’re considering this, see my guide to applying for Chase business cards with a sole proprietorship.

Sapphire Reserve Business instant approval

After submitting my application for the Sapphire Reserve Business, I was delighted to find that I was instantly approved, with a massive credit line no less. Historically, I haven’t been instantly approved for too many Chase business cards, so that was a pleasant surprise, since I was expecting I’d get a pending decision.

Furthermore, since I already have a few Chase business cards, I was wondering if I’d run into some issues, and would need my credit line reduced on another card. But nope, the situation was the best case scenario.

Of course it’s hard to know whether that’s just luck or what, but keep in mind that approval and underwriting standards aren’t always the same across cards. If a card issuer is trying to grow a card portfolio, it’s not unusual to see them maybe modify approval standards.

I can’t say for sure if that’s the case here, though if people have more data points, that would certainly be helpful!

My long term Sapphire Reserve Business strategy

The incredible welcome offer on the Sapphire Reserve Business was definitely a big motivator for picking up this card. I’m a huge fan of the personal version of the card, the Chase Sapphire Reserve, so in the long run, I’m going to need to figure out if one or both cards make sense for me.

For the time being, at least giving the card a try is a no brainer. While the card has a very high annual fee, it offers credits that can help offset that, with the $300 annual travel credit being the easiest of the bunch to use. Then there are things like a great rewards structure, lounge access, and more.

Still, given the overlapping benefits with the personal version of the card, it’s going to take me some time to figure out which card is the better value for me in the long run. On the plus side, I have at least a year to decide, so I’ll be sure to report back.

Bottom line

The Sapphire Reserve Business is Chase’s brand new premium business card. The card is offering a huge welcome bonus, and I know it’s a product that many people are eligible for. I just applied, and was delighted to find that I was instantly approved, which doesn’t often happen for me with Chase business cards.

I’m looking forward to giving this card a shot, and seeing how it fits into my card portfolio. In particular, I can’t argue with the massive welcome offer, which is a major incentive to pick up this product.

If you’ve applied for the Sapphire Reserve Business, what was your experience like?